TSMC’s rapid deployment is anticipated to increase its global market share from 57% in 2021 to 64% in 2025, according to Gartner, which has increased the CAGR of the foundry market from 2021 to 2025 to over 16%. The market for foundries as described by Gartner is less significant than we think. TSMC would hold a 52% market share if the 2021 foundry market were to be valued at US$109.9 billion. However, whether it is 52% or 57%, we can all agree that TSMC will continue to win because the foundry business is continually expanding.

TSMC thinks that in order to strengthen its leadership during the recession, it must use it to its advantage. While TSMC still has room to increase pricing for cutting-edge manufacturing methods or still has negotiating power when equipment deliveries are delayed, Samsung Electronics’s potential for development is being more constrained.

In the recent years, Samsung’s foundry division made up 17% of the global total. Samsung has focused on bolstering its foundry business in recent years. The System LSI department, which mostly handles foundry business, had its share increase from 16% to around 25% over the past two years, and it is currently approaching the 40% threshold in terms of the capex of its semiconductor division. The fact that the foundry services account for more than 80% of System LSI income demonstrates Samsung’s desire to grow the foundry industry and increase its financial contribution to the company.

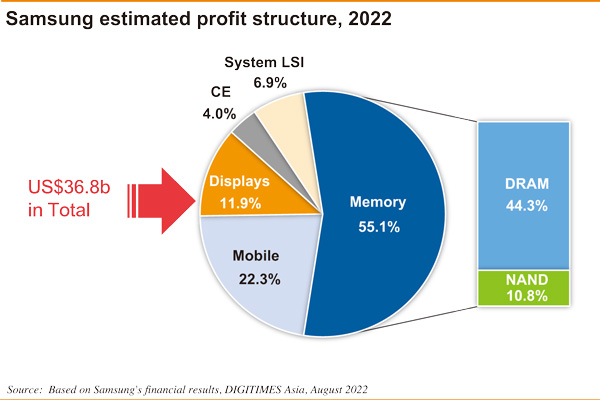

In the past, half of Samsung’s own foundry output came from its own application processors (APs), display driver ICs (DDIs), and even unique specification memory for the captive market. It is currently aggressively pursuing foundry orders from Qualcomm, Nvidia, and AMD, and there is a probability that its foundry business may rise by more than 20%. The foundry business is anticipated to provide 9.2% of the company’s sales in 2022, up from 7.3% in 2021, and a profit contribution that will more than double from 3% to over 6%.

In terms of foundry capex, Samsung is moving closer to TSMC: the capex disparity between the two companies has decreased from three times to approximately 2-2.5 times. However, TSMC has nearly 3.5 times the advanced EUV capacity of Samsung.

Additionally, TSMC keeps growing its customer base. According to estimates, TSMC has up to 1,000 clients, compared to only 150 clients for Samsung’s foundry unit. In reality, the two sides are not competing on an equal footing. In the race against TSMC, Samsung has been “provocative,” while TSMC hasn’t showed much interest in provocation. It will be exceedingly challenging for Samsung to compete directly with TSMC in the upcoming three to five years.

Launched in 2005, Samsung’s foundry division was broken apart from the AP/SoC, DDI, CIS, and other divisions in 2017 in an effort to minimize conflicts of interest while interacting with clients. Orders are anticipated from Qualcomm, Intel, and Nvidia. In particular, Samsung’s dominance in 3nm GAA technology will still provide it an opportunity to grow its foundry market share, and its early adoption of EUV technology in 4th generation DRAM technology is also very beneficial for building IP.

However, after years of attempts to increase its market share, Samsung’s global foundry market share has not significantly altered. The rise of foundries has primarily been fueled by the handset market in recent years, but high performance computing will be crucial in the next years (HPC).

According to estimates, Samsung’s 2021 capex will be made up of KRW10 trillion for DRAM, KRW12.5 trillion for NAND, and KRW13 trillion for foundries, for a total of KRW35.5 trillion, or roughly US$33.2 billion at the time. The Korean won had declined to 1,340 to the US dollar by the end of August 2022, which is increasing pressure on Samsung’s investment costs.

(Editor’s note: This is one of ten pieces about Samsung’s outlook that DIGITIMES Asia president Colley Hwang has written.)