After reporting record net profits for the third quarter, TSMC reduced its capex forecast for this year downward.

TSMC reduced its capex expectation for 2022 from an earlier estimate of around US$40 billion to US$36 billion, which is still a record high.

For the third quarter of 2022, TSMC announced net earnings up 18.5% sequentially to a record high of NT$280.87 billion (US$8.8 billion), with an EPS of NT$10.83.

The third quarter, when revenue increased 14.8% on a quarterly basis to NT$613.14 billion, saw TSMC’s gross margin surpass 60%. Revenue for TSMC increased by 11.4% sequentially and 35.9% on an annual basis to reach US$20.23 billion. The outcomes exceeded the company’s mid-July forecast.

In the third quarter, TSMC’s operating margin increased by 9.4 percentage points year over year and 1.5 percentage points sequentially to reach 50.6%. Gross margin increased by 9.1 percentage points year over year and 1.3 percentage points sequentially to reach 60.4%. Both outcomes exceeded the company’s projections.

Wendell Huang, VP and CFO of TSMC, stated that “high demand for our industry-leading 5nm technology boosted our third quarter business.”

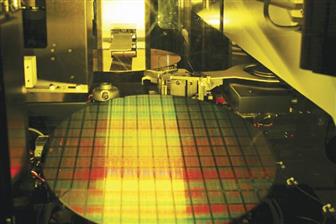

TSMC reported that in the third quarter, 28% of all wafer sales were made using the 5nm process technology. 54% of the quarter’s total wafer revenue came from advanced technologies, which are technologies with a 7nm or above manufacturing process.

In the fourth quarter of 2022, Huang stated, “We anticipate our business to remain flattish as end market demand diminishes and clients’ ongoing inventory adjustments are balanced by sustained ramp-up for our industry-leading 5nm technology.”

In the fourth quarter of 2022, TSMC anticipates revenue of between US$19.9 billion and US$20.7 billion, with gross margin and operating margin predictions of 59.5-61.5% and 49-51%, respectively.

TSMC: 2Q21- 2Q22 combined revenues (NT$m)

Quarter

Sales

18.5%

11.4%

* Figures have been combined.

TSE was created by DIGITIMES Asia in October 2022.

TSMC: 2Q21–2Q22 consolidated balance sheet (NT$k)

TSMC: 2Q21–2Q22 consolidated income statement (NT$k)

NT$k

0.6%

1%

9.1

6